The medical billing process is the financial heartbeat of any healthcare practice, yet it remains one of the most complex aspects of the industry. From the moment a patient schedules an appointment to the final reimbursement, a myriad of steps must occur with precision to ensuring providers get paid for their services.

For healthcare providers, administrators, and medical billers, understanding the medical billing process is not just about paperwork—it’s about financial survival. A streamlined billing cycle reduces administrative errors, accelerates cash flow, and ultimately improves the patient experience by minimizing surprise bills and confusion. Whether you are managing a small private practice or a large hospital system, mastering these steps is essential for maintaining a healthy revenue cycle.

In this guide, we will break down the medical billing cycles into actionable steps, explore best practices for efficiency, and highlight common pitfalls to avoid. By the end, you will have a clear roadmap to navigating the complexities of healthcare revenue management.

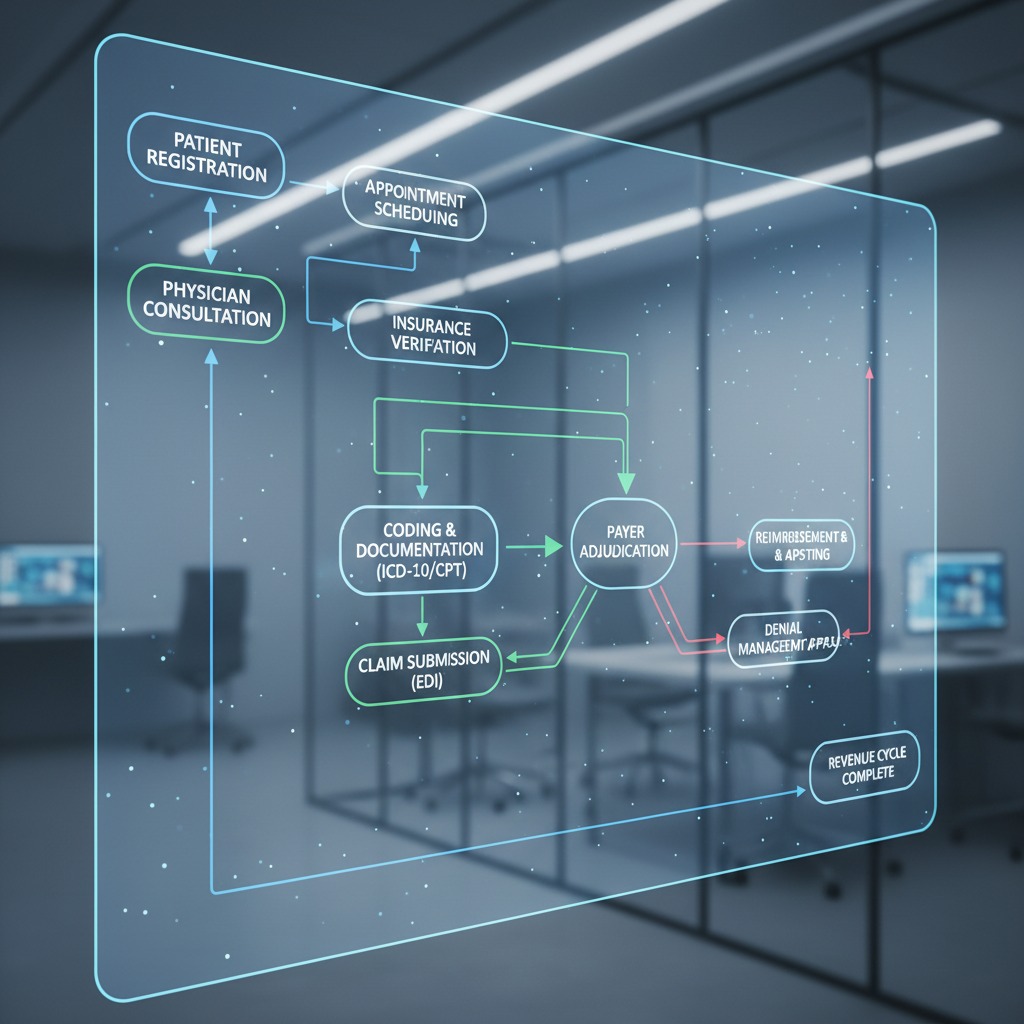

The Medical Billing Cycle: An Overview

The medical billing cycle is a series of administrative and financial tasks that healthcare providers perform to receive payment for medical services. This lifecycle begins when a patient registers for care and ends when the provider has received full payment.

Why is this cycle so critical? In the United States healthcare system, the payer model is intricate. Unlike retail, where payment is immediate, healthcare involves third-party payers (insurance companies), government entities (Medicare/Medicaid), and patients. Each stakeholder has specific rules, coding requirements, and timelines.

A breakdown in any part of this cycle—such as a simple typo in a patient’s date of birth or an incorrect diagnosis code—can lead to claim denials, delayed payments, and lost revenue. Therefore, revenue cycle management (RCM) is not merely a back-office function; it is a strategic necessity for the financial health of any medical organization.

Read More >> Regulatory Shifts in Medical Billing 2025: ICD-11, E/M Coding, Telehealth & What Providers Must Know

Step-by-Step Guide to the Medical Billing Cycle

To ensure accuracy and timely reimbursement, the billing process follows a structured path. While workflows may vary slightly depending on the software used or the size of the facility, the core stages remain consistent.

Patient Registration and Insurance Verification

The revenue cycle begins long before the doctor sees the patient. It starts at the front desk (or over the phone) during the registration process.

Collecting Patient Information: When a patient schedules an appointment, administrative staff must collect comprehensive demographic data. This includes the patient’s full legal name, date of birth, address, phone number, and social security number. Accuracy here is paramount; a misspelled name can cause an automatic rejection from an insurance payer weeks later.

Verifying Insurance Coverage and Benefits: Once the demographic data is secured, the staff must verify the patient’s insurance eligibility. This step involves contacting the insurance payer (or using an automated portal) to confirm:

- Is the coverage active?

- What are the patient’s benefits regarding the specific services they are seeking?

- What is the patient’s copayment and deductible status?

- Is a referral or prior authorization required?

The Importance of Front-End Processes: Errors at this “front-end” stage account for a significant portion of claim denials. If a patient’s insurance has expired or if the service isn’t covered, the provider needs to know immediately. Addressing financial responsibility with the patient upfront prevents “sticker shock” later and ensures the practice isn’t performing services for free.

Charge Capture and Medical Coding

Once the patient visits the provider, the clinical side of the process translates into the financial side. This bridge is built through charge capture and medical coding.

Recording Patient Encounter Notes: During the visit, the physician or healthcare provider records the details of the encounter in the Electronic Health Record (EHR). This documentation must be thorough, detailing the patient’s medical history, the examination findings, and the medical decision-making process. “If it isn’t documented, it didn’t happen” is the golden rule of medical billing.

Converting Notes to Standardized Codes: This is where medical coders step in. They review the provider’s clinical notes and translate them into universal alphanumeric codes. The two primary coding systems used are:

- ICD-10 (International Classification of Diseases): These codes describe the patient’s diagnosis or condition (e.g., why the patient sought care).

- CPT (Current Procedural Terminology): These codes describe the treatment or services provided (e.g., what the provider did).

Ensuring Coding Accuracy: Coders must ensure the codes align perfectly with the documentation. For example, using a code for a complex surgery when the notes only describe a minor procedure is considered “upcoding” and is a form of fraud. Conversely, “downcoding” results in lost revenue. Correct coding ensures compliance and accurate reimbursement.

Read More >> Prior Authorization Pain Points: Overcoming Inefficiency with Integrated ePA Solutions

Claims Submission

After the encounter is coded, the data is compiled into a medical claim.

Adding Charges to Medical Claims: The coded information is associated with specific fees based on the provider’s fee schedule. This creates the billable claim.

Scrubbing and Filing Claims: Before the claim leaves the practice, it undergoes a process called “claim scrubbing.” This is often done via software that checks for common errors, such as missing fields, incompatible codes, or invalid patient data. A “clean claim” is one that is error-free and likely to be processed without issue.

Using Electronic Data Interchange (EDI): Most claims are submitted electronically through a clearinghouse. The clearinghouse acts as a middleman, reformatting the claim data to meet the specific technical requirements of different insurance payers (e.g., Blue Cross, Aetna, Medicare) and securely transmitting it via Electronic Data Interchange (EDI).

Payer Adjudication

Once the insurance company receives the claim, the adjudication process begins. This is the financial evaluation of the claim by the payer.

Monitoring Payer Adjudication: During adjudication, the insurer reviews the claim against the patient’s benefit plan. They check for medical necessity, coverage limits, and correct coding.

Understanding Claim Status: The outcome of adjudication usually falls into three categories:

- Paid: The claim is approved, and reimbursement is issued.

- Denied: The claim is rejected based on coverage issues or errors.

- Pending: The payer needs more information (e.g., medical records) to make a decision.

The payer sends back an Electronic Remittance Advice (ERA) to the provider and an Explanation of Benefits (EOB) to the patient, detailing what was paid, what was adjusted, and what the patient owes.

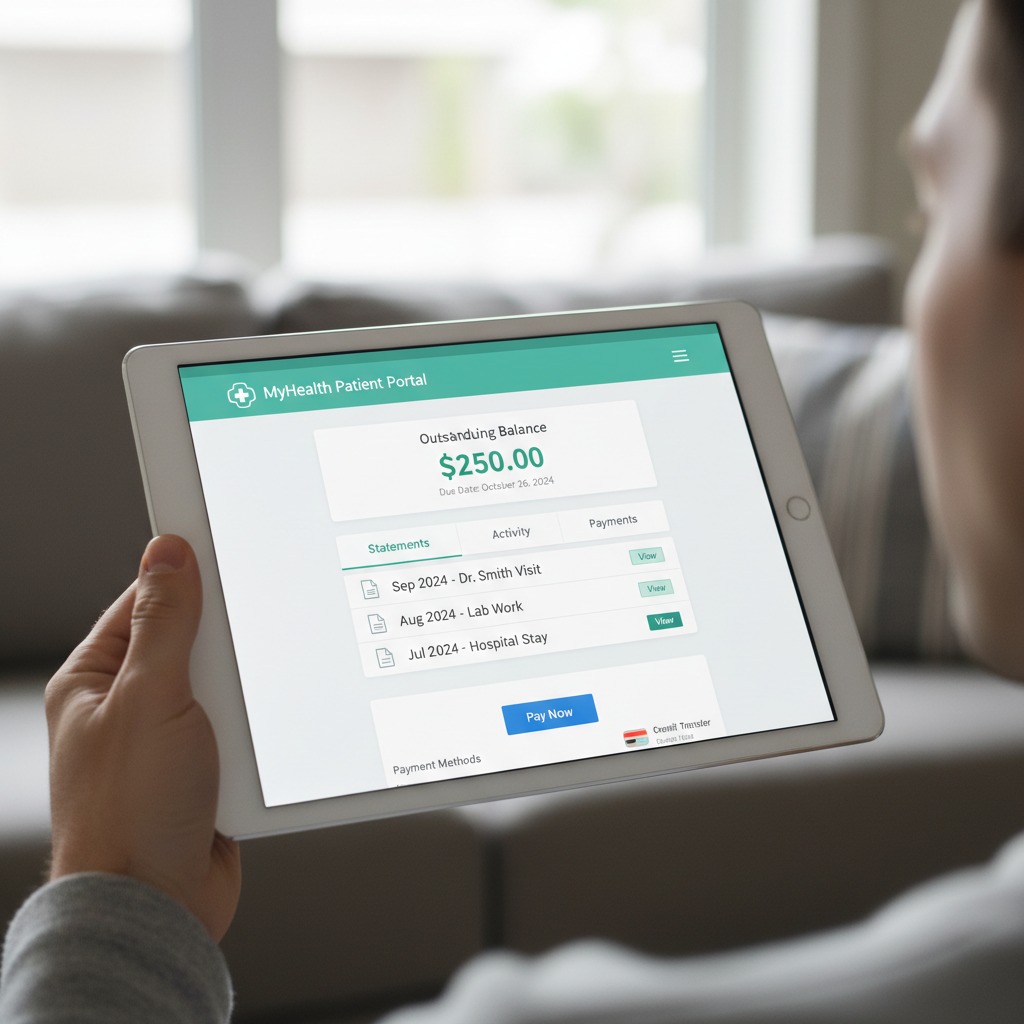

Patient Statements and Payment

After the insurance has paid its portion, the focus shifts to the patient.

Sending Patient Statements: If there is a remaining balance (such as a deductible, coinsurance, or copay not collected upfront), the billing department generates a statement. This invoice explains the total charges, what insurance covered, and the final amount due from the patient.

Pursuing Payment and Managing Collections: Timely follow-up is essential. Practices often send automated reminders via text or email. If a balance remains unpaid for an extended period (usually 90+ days), the practice must decide whether to continue internal collection efforts, write off the debt, or send the account to a collections agency.

Read More >> Medical Billing Errors Spiking The Hidden Costs of RCM: How to Avoid Them?

Denial Management and Appeals

A denial is not the end of the road. Effective denial management is crucial for recovering revenue that would otherwise be lost.

Resolving Claim Denials and Rejections: Billers must investigate why a claim was denied. Was it a duplicate claim? Was the patient ID number wrong? Was prior authorization missing?

Correcting Issues and Resubmitting Claims: Once the root cause is identified, the biller corrects the error and resubmits the claim. If the denial was due to a disagreement over medical necessity, the provider may need to file an appeal, providing additional clinical evidence to support the treatment provided.

Best Practices for Efficient Medical Billing

To keep the medical billing process running smoothly and maximize revenue, healthcare organizations should adopt specific best practices.

Technology and Automation: Manual billing is prone to human error. Utilizing robust Practice Management Systems (PMS) and EHR software can automate repetitive tasks. Automated eligibility verification tools can check insurance status days before an appointment. Claim scrubbing software significantly increases the “first-pass” acceptance rate by catching errors before submission.

Regular Audits and Compliance Checks: Healthcare regulations (like HIPAA) and payer rules change frequently. Conducting regular internal audits ensures that the billing team is adhering to current standards. Audits can identify patterns in coding errors or recurring denial reasons, allowing the practice to implement training to fix systemic issues.

Outsourcing Medical Billing: For many practices, managing the entire billing cycle in-house is overwhelming and costly. Outsourcing to a specialized medical billing company can be a strategic move. These companies have dedicated experts whose sole focus is keeping up with coding changes and chasing down denials. While this involves a cost (usually a percentage of collections), the increase in revenue and the reduction in administrative burden often yield a high return on investment.

Conclusion

Medical billing is the lifeblood of healthcare operations, yet its complexity often pulls attention away from patient care. At Care Medicus, we know that while billing cycles involve detailed data collection, precise coding, and persistent follow-up, they do not have to be overwhelming or disruptive. With the right strategy in place, billing can become a source of stability rather than stress.

A well-structured revenue cycle does more than keep operations running—it builds trust with patients who expect clarity and accuracy, and it gives providers the freedom to focus on delivering quality care instead of resolving financial disputes. By prioritizing accuracy at the front desk, leveraging technology to streamline claim submission, and taking a proactive approach to denial management, healthcare organizations can create a billing process that supports both clinical and financial goals.

Now is the time to strengthen your foundation. With deep expertise in revenue cycle optimization and compliance-driven workflows, Care Medicus helps healthcare providers transform complex billing operations into efficient, reliable systems that drive long-term financial success—so your team can focus on what matters most: caring for patients.

Leave a Reply