The healthcare landscape has shifted dramatically in the last few years. What was once a convenient “add-on” service has become a cornerstone of modern medicine. In fact, telehealth grew faster than any other type of medical care recently, experiencing a massive 53% surge in usage. Today, over 76% of U.S. hospitals connect with patients remotely, allowing providers to screen for viruses, manage chronic conditions, and offer mental health support without a physical office visit.

However, while the technology to deliver virtual care has rapidly advanced, the financial infrastructure is still playing catch-up. For providers, the ability to see patients online is only half the battle. The other half—and often the more difficult half—is ensuring you get paid fairly for those services. This is where the concept of “payment parity” and robust Revenue Cycle Management (RCM) becomes critical.

Navigating the maze of insurance reimbursement rules, state-specific mandates, and shifting federal regulations can feel impossible. Yet, mastering these elements is the only way to ensure your practice remains financially viable. Whether you are a solo practitioner or a large hospital system, understanding how to align your billing processes with current parity laws is essential. In this guide, we will break down the complexities of billing for virtual care and introduce how modern solutions like FinanceCore AI are helping providers close the gap between care delivery and fair compensation.

What is Telemedicine Payment Parity?

At its core, telemedicine payment parity is a simple concept: it requires insurers to reimburse providers for telehealth services at the same rate they would pay for an equivalent in-person visit. If a doctor gets paid $100 to diagnose a sinus infection in their office, payment parity dictates they should receive $100 to diagnose that same infection via a secure video call.

The Evolution of Parity Policies

Historically, telemedicine was often reimbursed at significantly lower rates than in-person care. Before the widespread adoption of virtual care, Medicare telehealth rates often started as low as $15 per call, which researchers noted didn’t even cover the basic costs of billing and documentation.

The COVID-19 pandemic forced a rapid evolution. The Centers for Medicare & Medicaid Services (CMS) issued emergency waivers that temporarily required Medicare to pay for telehealth visits at the same rate as in-person visits. This included removing geographic restrictions and allowing patients to receive care in their homes—a massive shift from the previous requirement that patients be located at a specific medical facility (the “originating site”) to qualify for coverage.

Coverage vs. Payment

It is vital to distinguish between “coverage parity” and “payment parity.”

- Coverage Parity: Requires insurers to cover a service delivered via telehealth if they cover it in person. However, it does not guarantee how much they will pay.

- Payment Parity: Mandates that the reimbursement amount must be equal to the in-person rate.

While many states have enacted laws regarding coverage, true payment parity remains a battleground. Without strict payment parity laws, insurers may cover a video visit but reimburse it at 50% or 75% of the standard rate, squeezing practice margins.

Read More >> Telehealth Billing and Reimbursement: A Point of Attention for Healthcare Providers

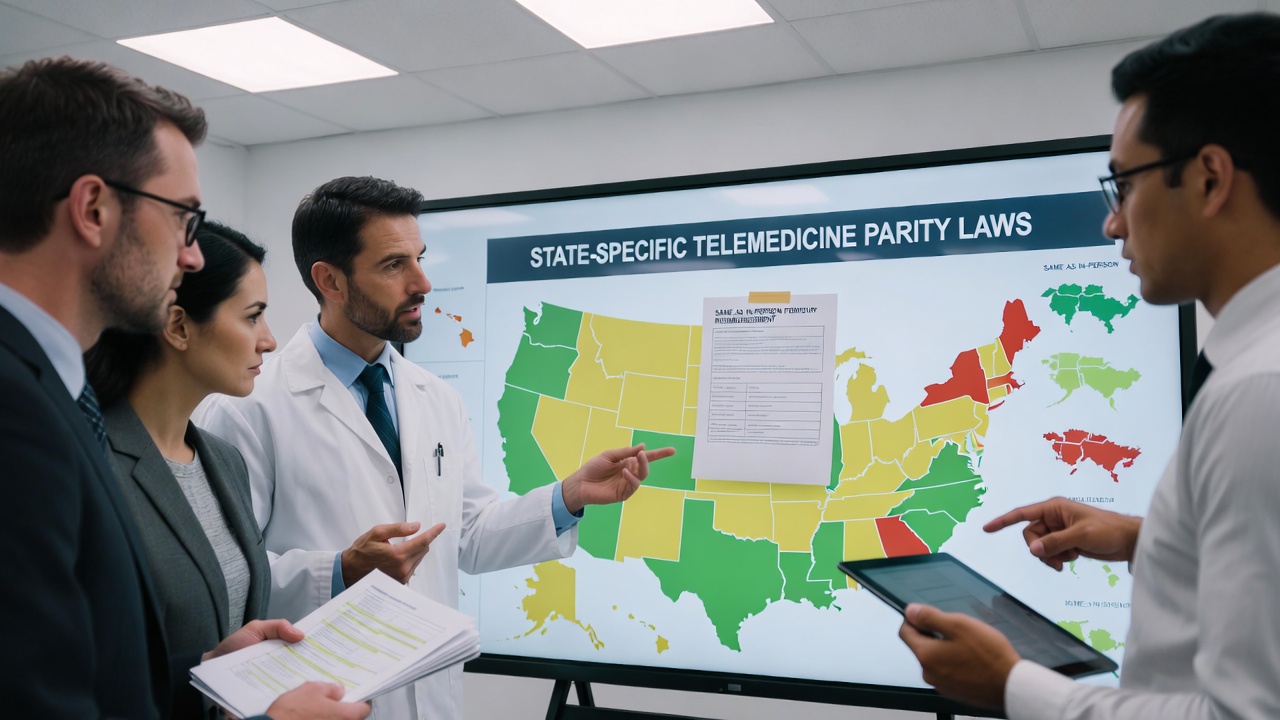

The Current Landscape of Telemedicine Payment Parity

The current status of payment parity is best described as a patchwork. Because insurance regulation often falls to individual states, a provider in New York faces a completely different financial reality than a provider in Texas.

State-by-State Variations

Currently, 44 states and Washington, D.C., have laws that govern private payer reimbursement policies for telehealth. However, having a law on the books does not guarantee equal pay.

- Explicit Payment Parity: As of late 2025 projections, only about 24 states have explicit requirements for payment parity.

- Coverage Mandates: Most jurisdictions require parity in covered services but allow payers to limit the reimbursement amount.

For example, New York has robust mandates requiring reimbursement for telehealth at the same rate as equivalent in-person care through at least 2025. Conversely, other states may have language that is more ambiguous, allowing insurers to negotiate lower rates.

The Language of Legislation

When reviewing contracts and state laws, the specific wording matters immensely.

- “The same as”: This is the gold standard for providers. It legally binds the insurer to pay the full in-person rate.

- “Not less than”: Similar to “the same as,” this protects the reimbursement floor.

- “Not more than”: This phrasing can be dangerous for RCM, as it effectively caps reimbursement without setting a minimum.

The Post-Pandemic Reality

We are currently in a transition period. Many of the broad flexibilities granted during the public health emergency were temporary. While Medicare has extended many telehealth services, private payers in states without permanent parity laws are beginning to roll back reimbursement rates. This creates a volatile environment for Revenue Cycle Management, where a claim paid at 100% last month might be paid at 80% next month.

Revenue Cycle Management (RCM) Challenges in Virtual Care

Adapting traditional RCM practices to a remote care delivery model introduces unique friction points. Telemedicine RCM requires a different approach to verification, coding, and denial management.

Insurance Verification and Eligibility

The first step in the revenue cycle—verifying insurance—is the most critical for telehealth. Industry data suggests that insurance verification issues account for a 28% denial rate. In a virtual setting, you cannot physically check a patient’s insurance card. Furthermore, you must verify if the patient’s specific plan covers telehealth and if there are restrictions on the “originating site” (where the patient is located).

Cross-State Billing Complexities

Telehealth removes physical borders, but it does not remove legal ones. Providers treating patients across state lines must navigate the specific billing rules of the patient’s location. A provider in a state with parity laws treating a patient in a state without them may face unexpected payment reductions. This creates massive “coverage gaps” that traditional RCM teams struggle to track manually.

The High Cost of Denials

The rapid growth of healthcare often leads to billing errors. Key areas where money is lost include:

- Prior Authorization: Failure to obtain prior auth for virtual visits leads to a 35% denial rate in some sectors.

- Coding Errors: Incorrect use of modifiers or place-of-service codes accounts for roughly 22% of denials.

Read More >> The Clinical Pathology Trap: Solving for Frequency Caps and Scrutiny on Modifier 91

Coding for Compliance and Maximum Reimbursement

To ensure revenue integrity, billing teams must be precise. “To not leave any money on the table means providers must document everything,” specifically focusing on the nuance between an in-person visit and a virtual one.

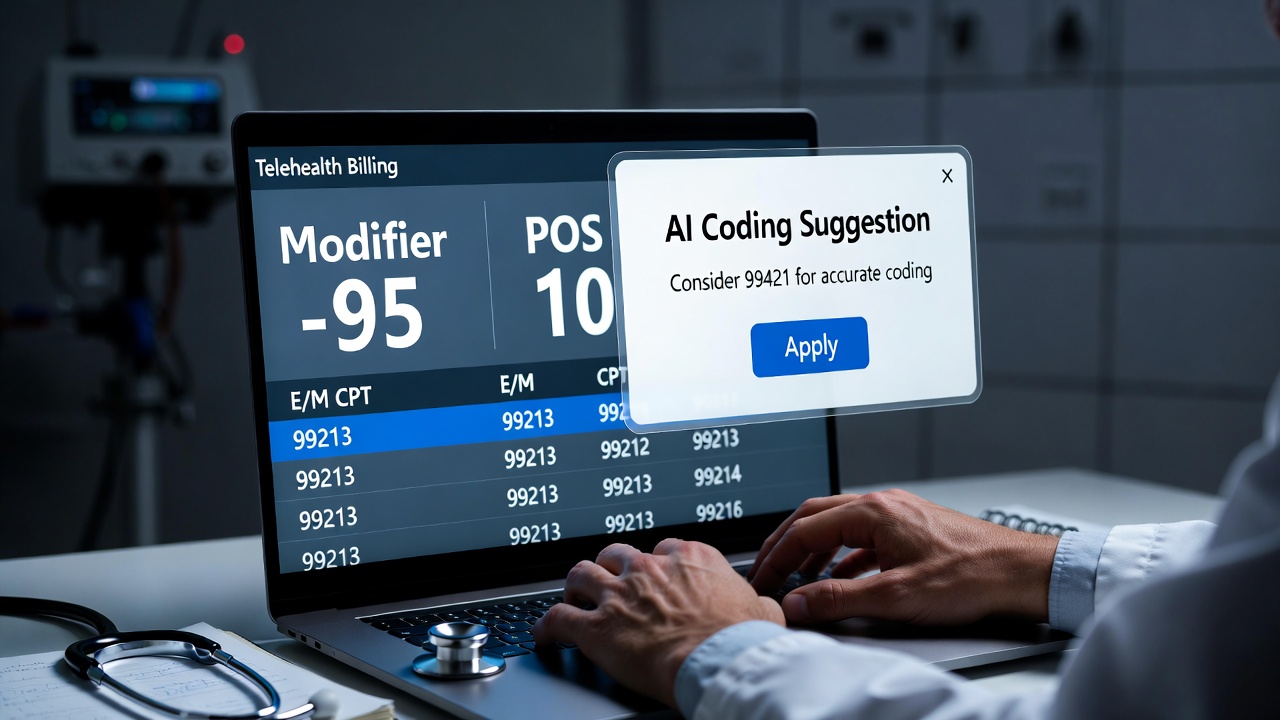

Essential CPT Codes and Modifiers

Medical practices generally use the standard Evaluation and Management (E/M) codes for telehealth (99202-99215), but they must be flagged correctly to trigger payment.

- Modifier -95: This is the most common modifier used to indicate a synchronous telemedicine service rendered via a real-time audio and video system.

- Place of Service (POS) 02: Used when the telehealth service is provided outside the patient’s home.

- Place of Service (POS) 10: Used when the patient is located in their home. This distinction is crucial as reimbursement rates can vary based on the POS code.

New Codes on the Horizon

The American Medical Association (AMA) and CMS continue to update code sets. Beginning in 2025, the AMA has introduced a set of dedicated telemedicine CPT codes. These are designed to distinguish virtual encounters from traditional visits more clearly. Staying updated on these changes is vital; using an expired or incorrect code is the fastest route to a claim denial.

Documentation Standards

Auditors are paying close attention to telehealth. The Office of Inspector General has announced audit plans specifically targeting telehealth billing related to COVID-19. To protect your revenue, documentation must be airtight. This means verifying the patient’s location during the call, the technology used (audio/video), and the total time spent. Avoid “cloned” notes where every virtual visit looks identical, as this raises red flags for auditors.

Leveraging FinanceCore AI for RCM Success

Given the complexity of state laws, varying payer contracts, and evolving codes, manual RCM processes are becoming obsolete. This is where technology partners like FinanceCore AI are transforming the industry.

Automating Verification

FinanceCore AI helps solve the “front-end” problem. By automating insurance verification, the system can instantly check a patient’s coverage for telehealth specifically. This prevents the scenario where a physician spends 20 minutes with a patient, only to find out later that the visit isn’t covered.

Intelligent Coding and Denial Prevention

AI-driven solutions can analyze clinical notes against billing codes in real-time. FinanceCore AI can flag inconsistencies—such as a missing -95 modifier or a mismatch between the diagnosis and the service code—before the claim is ever submitted. This moves the RCM process from “reactive” (fixing denials) to “proactive” (sending clean claims).

Analyzing Payer Behavior

One of the biggest advantages of AI is its ability to spot trends. FinanceCore AI can analyze payment patterns across different payers. If a specific insurer suddenly stops reimbursing for a certain CPT code or starts down-coding visits, the system identifies the anomaly immediately, allowing your practice to adjust or appeal in bulk.

Read More >> The Cost of Complacency: Why “Legacy” Outsourcing is Failing Modern Clinics

Future-Proofing Your Practice

Telehealth is no longer a temporary solution—it is a permanent part of modern care delivery. But as virtual care expands, reimbursement is becoming more complex, not simpler. Payment parity laws offer guidance, not guarantees, and the responsibility for accurate documentation and compliant billing ultimately rests with providers. At Care Medicus, we understand that succeeding in telehealth requires more than delivering care remotely—it requires a revenue strategy built for complexity.

To maximize reimbursement, practices must move beyond basic billing workflows. Success demands a strategic approach that combines a deep understanding of parity legislation, rigorous clinical documentation, and intelligent technology that adapts to evolving payer rules. By leveraging advanced tools such as FinanceCore AI, healthcare organizations can ensure that their telehealth services are supported by a revenue cycle that is predictable, compliant, and fair.

Telehealth has removed barriers to access and transformed how patients receive care. Now it’s time to remove the barriers to payment. With expertise in telehealth billing, compliance, and AI-driven revenue cycle optimization, Care Medicus helps providers protect reimbursement, reduce risk, and focus confidently on delivering high-quality virtual care—without financial uncertainty standing in the way.

Leave a Reply