Every healthcare provider knows the frustration of a denied claim. You provided the care, your team documented the visit, and you submitted the bill—only to have it kicked back weeks later because of a transposed digit or a missing modifier. It’s a silent drain on your revenue cycle, one that siphons billions from the healthcare industry every year. The solution isn’t just working harder; it’s about working smarter by deploying “invisible scribes. Invisible Scribes, building an internal claims scrubbing process that actually works is not just a dream anymore; it is the strategic framework necessary to stop revenue leakage before it starts.

By implementing a robust internal claim scrubbing system, medical practices can catch errors before they ever reach the payer. This proactive approach transforms your billing department from a reactive cleanup crew into a proactive revenue defense line. In this guide, we will explore exactly how to construct this process, leverage modern technology, and secure your practice’s financial health.

Introduction to Claim Scrubbing

At its core, claim scrubbing is the rigorous process of auditing medical claims for errors, omissions, and inconsistencies before they are submitted to insurance payers. Think of it as a spell-check for medical billing, but with significantly higher stakes. An effective scrubbing process reviews specific data points—such as CPT codes, ICD-10 diagnoses, patient demographics, and modifier usage—to ensure they align with the strict and ever-changing rules set by payers.

Why Is It Important?

The primary goal of claim scrubbing is to achieve a “clean claim”—a claim that is paid on the first submission without being rejected or denied. Without this safety net, practices are essentially gambling with their revenue. If a claim contains errors, it triggers a denial. This doesn’t just mean a delay in payment; it initiates a costly administrative cycle of researching the error, correcting it, resubmitting the claim, and waiting for adjudication all over again.

Beyond cash flow, claim scrubbing is vital for compliance. Inaccurate coding can be flagged as potential fraud or abuse by payers or government entities like CMS. A consistent scrubbing process demonstrates due diligence, protecting your practice from audits and potential fines.

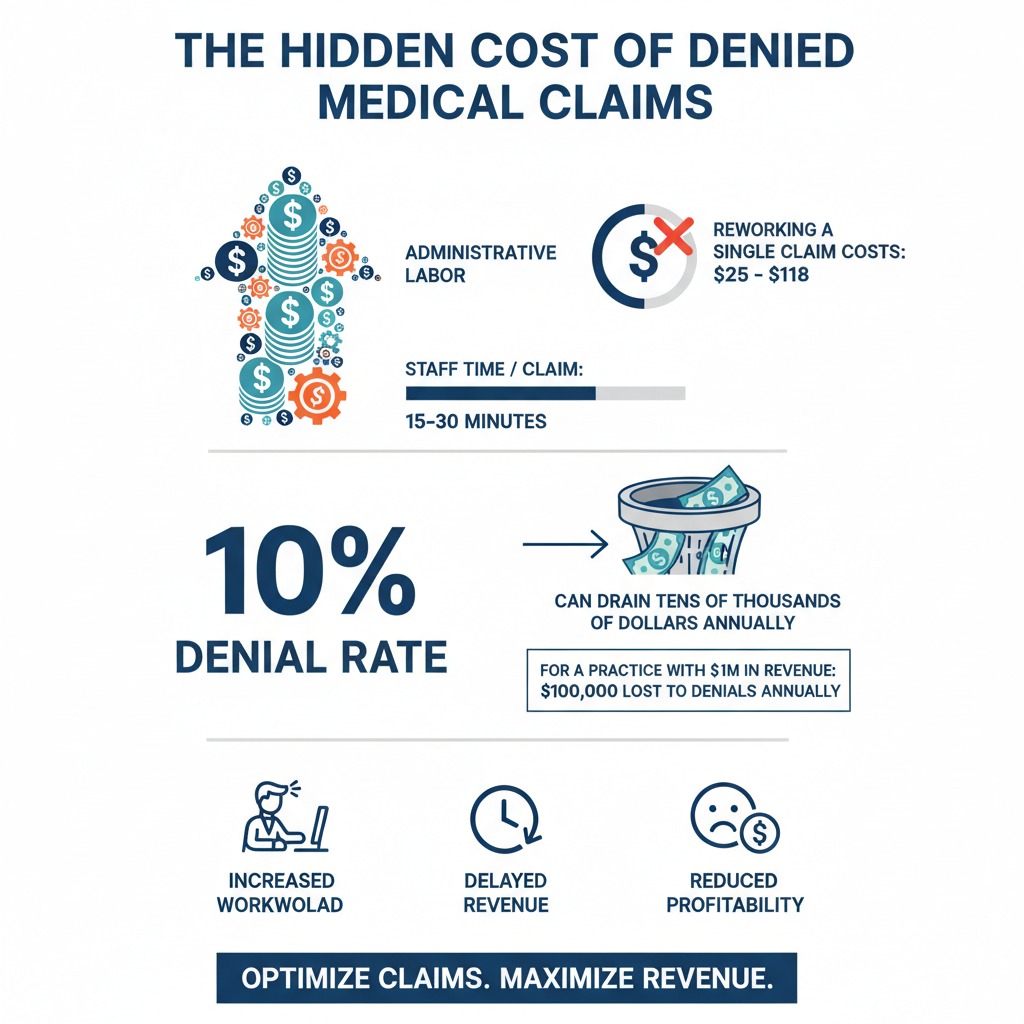

The Financial Impact of Claim Denials

The cost of inaction is staggering. Industry data suggests that billing mistakes and claim denials cost the U.S. healthcare system billions annually. On a micro level, the impact is equally severe. Reworking a single denied claim costs an average of $25 to $118 depending on the complexity and staff time involved.

If your practice has a denial rate of 10% and you submit 5,000 claims a year, you aren’t just losing time; you are potentially spending tens of thousands of dollars in administrative labor just to recover money you have already earned. Effective claim scrubbing can reduce these denials by up to 90%, turning potential write-offs into realized revenue.

The Challenges of Traditional Claims Scrubbing

While the concept of checking work before submission seems obvious, the execution has historically been difficult. Many practices still rely on outdated methods that simply cannot keep pace with the modern healthcare environment.

Manual Processes and Human Error

Traditionally, claim scrubbing was a manual task. Billing staff would visually inspect claims, cross-referencing codes with cheat sheets or memory. While human oversight is valuable, it is not scalable. Fatigue sets in, attention wavers, and simple typos—like swapping a patient’s birth month and day—slip through. In high-volume practices, relying solely on manual review creates a bottleneck that slows down submission times and inevitably leads to errors.

Inconsistent Application of Rules

One of the biggest hurdles in medical billing is the sheer volume of rules. Medicare has its own set of guidelines (NCDs and LCDs), Medicaid has another, and every commercial payer—from Blue Cross to UnitedHealthcare—has its own proprietary policies. To make matters worse, these rules change frequently.

A manual process struggles to adapt to these shifts. A biller might apply a rule that was valid last year but results in a denial today. Without a centralized, automated way to update these rules, inconsistent application becomes the norm, leading to fluctuating denial rates that are hard to diagnose and fix.

Lack of Real-Time Feedback

In traditional workflows, the feedback loop is broken. A biller submits a claim and might not hear back for 14 to 30 days. By the time the denial arrives, the context of that specific patient visit is gone. The staff member has to dig back into the medical record, reconstruct what happened, and try to fix it. A robust internal scrubbing process needs to provide immediate feedback, flagging errors the moment data is entered so they can be corrected while the information is fresh.

Read More >> Beyond the Appeal: Building an “Autonomous” Denial Prevention Strategy

Building an Internal Claims Scrubbing Process

Creating a system that works requires more than just buying software; it requires a structural shift in how your practice handles data. Here is how to build your “invisible scribes” from the ground up.

Establishing Clear Protocols and Workflows

Before you automate, you must standardize. You need a clear map of the life cycle of a claim within your practice.

- Patient Intake: Ensure front-desk staff have a checklist for verifying demographics and insurance eligibility. Up to 20% of denials stem from eligibility errors that occur before the patient even sees the doctor.

- Coding: Define who is responsible for selecting codes. Is it the provider? A certified coder? Establish a protocol for how codes are validated against the clinical documentation.

- The Scrub: Determine at what point the scrubbing occurs. Ideally, it should happen twice: once at charge entry and again right before batch submission.

Leveraging Technology for Automation

You cannot scale accuracy without technology. Modern practice management systems (PMS) and dedicated clearinghouses offer automated rule engines. These are your digital invisible scribes. They can instantly check for:

- Syntax errors: Missing NPI numbers, invalid zip codes, or incomplete policy IDs.

- Coding logic: Ensuring the diagnosis code supports the procedure code (medical necessity).

- Modifer usage: Flagging procedures that require modifiers like -25 or -59.

Implementing these tools moves the heavy lifting from your staff to the software, allowing your team to focus only on the complex “exceptions” that the software flags.

Training Staff on Claim Scrubbing Processes

Technology is only as good as the people operating it. If your billing staff ignores the flags raised by your software because they don’t understand them, the system fails. Regular training is non-negotiable.

Your team needs to understand why a claim was flagged. Is it a bundling issue? A local coverage determination (LCD) conflict? When staff understand the “why,” they stop viewing scrubbing alerts as annoying pop-ups and start seeing them as critical safeguards. Furthermore, when payer rules change, your team needs immediate education on how those changes affect their daily scrubbing workflow.

Conducting Regular Audits

Even the best automated systems have blind spots. Establishing an internal audit cadence is crucial for quality assurance. Randomly select a percentage of “clean” claims and review them manually to ensure the software isn’t missing anything. Conversely, review your denials every month to see what slipped through the scrubber. If you notice a trend—for example, a specific injection code being denied for medical necessity—you can update your scrubbing rules to catch that specific scenario in the future.

Implementing AI for Smarter Claims Processing

The next frontier in claim scrubbing moves beyond simple “if/then” rules and utilizes Artificial Intelligence (AI) and Machine Learning (ML).

Using AI-Powered Claim Scrubbers

Traditional scrubbers are rule-based. They know that Code A requires Code B. AI scrubbers, however, are predictive. They analyze vast amounts of historical data to identify complex patterns that a human or a simple rule engine might miss.

For example, an AI agent can analyze unstructured data, such as physician notes, using Natural Language Processing (NLP). It can “read” the chart, compare it to the codes selected, and flag a potential discrepancy where the documentation doesn’t fully support the level of service billed. This level of semantic analysis acts as a highly sophisticated invisible scribe, catching nuance that standard validation misses.

Improving Accuracy and Reducing Denial Rates

AI systems learn from your denials. If a payer suddenly starts denying a specific code combination that was previously accepted, a rule-based system needs a human to manually update it. An AI system, however, can detect this anomaly in the remittance data and automatically suggest a new scrubbing rule to prevent future denials of the same type. This dynamic adaptation is key to maintaining a high clean claim rate in a volatile payer environment.

By predicting denial risk scores, AI can also prioritize work. It can flag claims that are 90% likely to be denied, directing your most experienced billers to review those specific high-risk claims before they leave the building.

Read More >> AI Clinical Workflows in Action: Real-World Examples of Human-AI Synergy

Measuring Success

You cannot improve what you do not measure. To know if your internal scrubbing process is working, you must track specific Key Performance Indicators (KPIs).

KPIs for Monitoring Progress

- Clean Claim Rate: This is your north star. It measures the percentage of claims that pass through your scrubber and are accepted by the payer on the first pass without rejection. A healthy practice should aim for a rate exceeding 95%.

- Denial Rate: Track this monthly. If your scrubbing process is effective, this number should trend downward.

- Days in Accounts Receivable (A/R): Effective scrubbing speeds up payment cycles. If your days in A/R are dropping, it means your claims are cleaner and being processed faster.

- Scrubber Lag Time: How long does a claim sit in the “scrubbing” queue? It’s important to ensure your validation process isn’t creating its own bottleneck.

ROI for In-House vs. Outsourced Billing Services

Building an internal process requires investment in software and training. However, the ROI is often substantial. By keeping billing in-house with robust scrubbing, you retain control over your revenue cycle and avoid paying a percentage of collections to a third-party billing company.

However, for some smaller practices, the cost of advanced technology and skilled staff might outweigh the benefits. In these cases, outsourcing to a partner who already utilizes high-end AI scrubbing tools can be a cost-effective alternative. The key is to compare the cost of your internal resources (salaries + software) against the potential revenue recovered through lower denial rates.

The Way Forward

The era of “submit and pray” is over. In a healthcare environment defined by shrinking margins and increasingly complex regulations, the ability to submit clean, accurate claims is no longer optional—it is a competitive advantage. At Care Medicus, we believe taking control of your claims process is about more than avoiding denials; it’s about owning your financial future.

By combining standardized, disciplined human workflows with advanced AI-driven technology, healthcare organizations can build an internal claims scrubbing ecosystem that is resilient, efficient, and scalable. These modern “invisible scribes” work behind the scenes to identify risks before submission, apply payer-specific rules with precision, and shift revenue cycle management from reactive correction to predictive accuracy and strategic control.

Now is the time to move beyond chasing denied dollars. Whether you are a small clinic or a large hospital system, investing in intelligent claims scrubbing delivers long-term returns—cleaner claims, faster reimbursement, and fewer administrative distractions. With deep expertise in AI-enabled revenue cycle optimization, Care Medicus helps organizations implement claims scrubbing processes that actually work—so your teams can stop fighting denials and start focusing on what matters most: patient care.

Leave a Reply