Medical billing is the financial backbone of any healthcare practice. It translates the complex care provided to patients into a standardized language of codes that insurers use to issue payment. However, in an environment where reimbursement models are constantly evolving and administrative burdens are high, the line between maximizing revenue and committing fraud can sometimes blur.

For practice managers, physicians, and billing specialists, the pressure to maintain financial viability is intense. This pressure, combined with the sheer complexity of coding systems like CPT, ICD-10, and HCPCS, creates a landscape ripe for errors. Two of the most common—and dangerous—pitfalls in this landscape are upcoding and downcoding.

While they represent opposite ends of the spectrum, both practices pose significant threats to a healthcare organization’s reputation, financial health, and legal standing. Understanding the mechanics of ethical billing is not just about avoiding penalties; it is about building a sustainable business model rooted in trust and integrity.

The Pillars of Ethical Billing

Before diving into the specific risks of coding errors, it is essential to define what ethical billing actually looks like. Ethical billing is the practice of submitting claims that accurately reflect the medical services provided, supported by precise documentation. It is not merely about following the law; it is about adhering to core principles of honesty, transparency, and fairness.

Honesty and Accuracy: At its core, ethical billing demands that the claim tells the truth. If a physician spent 15 minutes with a patient, the code submitted must reflect a 15-minute encounter, not a 45-minute comprehensive exam. Accuracy ensures that the healthcare system functions correctly, allocating resources where they are actually utilized.

Transparency: Patients have a right to understand their financial obligations. Transparent billing practices help demystify the often opaque world of healthcare costs. When a practice bills ethically, they reduce the likelihood of surprise bills and disputes, fostering a stronger relationship between the provider and the patient.

Fairness: Fairness involves treating all patients and payers equally. It means avoiding discrimination in billing based on insurance status and ensuring that fees are reasonable and customary for the services rendered.

Ethical billing protects the practice from external audits, but it also protects the patient. When billing accurately reflects the patient’s condition, their medical record remains a truthful history of their health, which is vital for future care coordination.

Upcoding: The High-Risk Gamble

Upcoding occurs when a healthcare provider submits a billing code for a service that is more complex, expensive, or severe than the service actually provided. The intent—or the accidental result—is an inflated reimbursement payment from the insurance payer or government program.

While it might be tempting to view slight increases in coding levels as a way to boost revenue, upcoding is illegal. It is considered a form of medical billing fraud.

Common Examples of Upcoding

Upcoding can take many forms, ranging from subtle shifts in Evaluation and Management (E/M) codes to blatant misrepresentation of services.

- Time Inflation: This is one of the most common forms. For example, a provider spends 10 minutes with a patient for a minor check-up but bills for a 30-minute detailed consultation.

- Severity Inflation: A patient presents with a routine cold, but the claim includes codes for pneumonia or a more severe respiratory infection to justify higher reimbursement or more testing.

- Mismatched Patient Status: Using a “New Patient” code for an individual who is actually an “Established Patient.” New patient visits typically reimburse at a higher rate due to the extra work involved in initial intake.

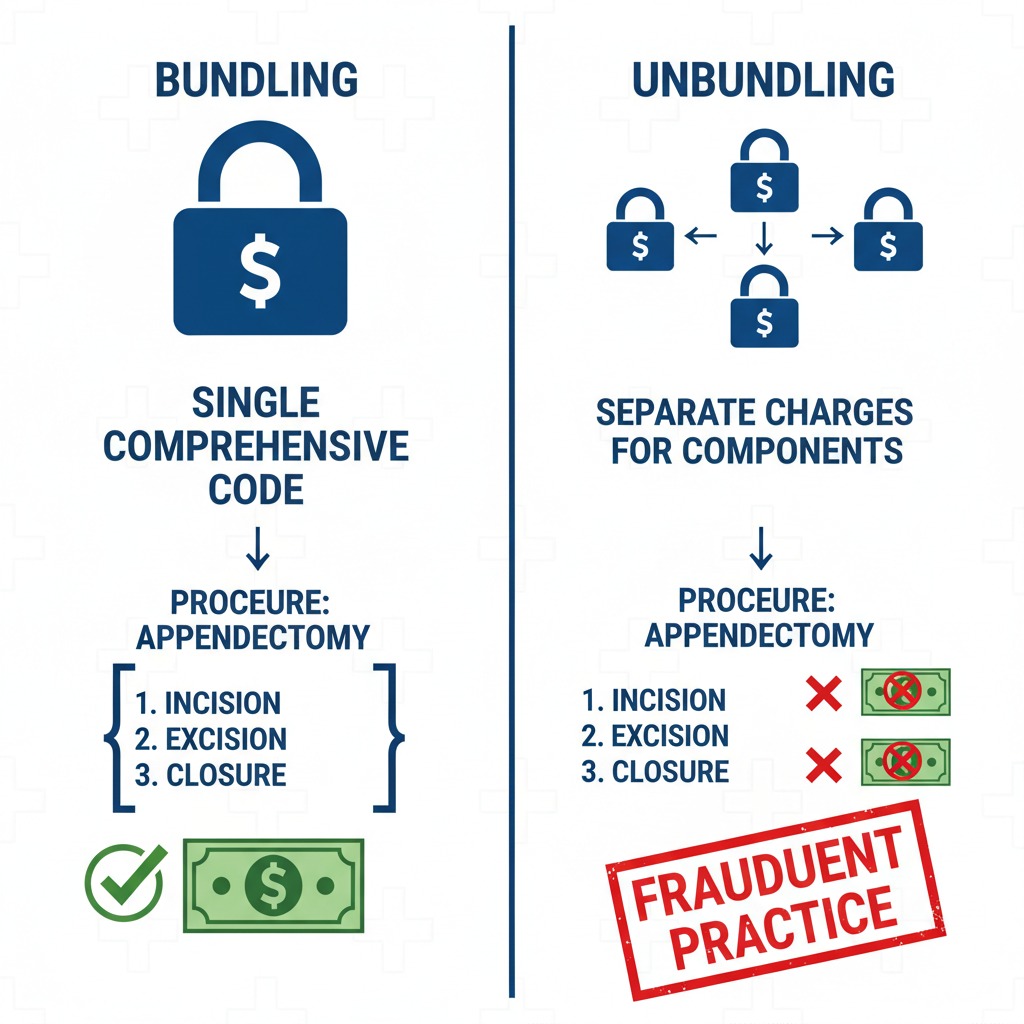

- Unbundling: This involves taking a procedure that has a single, comprehensive billing code and breaking it down into its component parts to bill for each separately. For instance, if a surgery includes the incision and closure in one “bundled” payment, unbundling would mean billing for the incision, the procedure, and the closure as three distinct charges.

The Consequences of Upcoding

The risks associated with upcoding are severe. Federal programs like Medicare and Medicaid take a zero-tolerance approach to fraud.

Legal Penalties and The False Claims Act (FCA): The False Claims Act is the government’s primary tool for combating healthcare fraud. Violations can lead to civil penalties of thousands of dollars per false claim, plus three times the amount of the government’s damages. In 2023 alone, enforcement efforts highlighted billions in fraudulent claims.

Criminal Prosecution: Upcoding isn’t just a civil matter; it can lead to prison time. For example, a California doctor, Donald Woo Lee, was sentenced to prison for defrauding Medicare by upcoding procedures and billing for unnecessary services. This highlights that the Department of Justice actively pursues individuals, not just corporations.

Reputational Damage: Beyond fines and jail time, a fraud investigation can destroy a career. Exclusion from federal healthcare programs (meaning you can no longer bill Medicare or Medicaid) is a death knell for many practices. Furthermore, the loss of patient trust is often irreversible.

Read More >> The Clinical Pathology Trap: Solving for Frequency Caps and Scrutiny on Modifier 91

Downcoding: The Silent Revenue Killer

If upcoding is the aggressive pursuit of unearned money, downcoding is the defensive retreat that leaves earned money on the table. Downcoding occurs when a provider submits a code for a service that is less complex or expensive than the one actually performed.

Many providers downcode intentionally, believing it will help them fly under the radar of insurance auditors. This “defensive billing” strategy is a misconception that carries its own set of risks.

Why Does Downcoding Happen?

- Fear of Audits: Providers may worry that their documentation isn’t strong enough to support a high-level code, so they default to a lower one to be “safe.”

- Insurer Adjustments: sometimes, the insurance payer downcodes the claim themselves during the review process if they believe the documentation doesn’t support the billed level of service.

- Poor Documentation: If a physician performs a complex procedure but fails to document the specific details required for the higher-level code, the coding staff must select the code that matches the written record, resulting in downcoding.

The Dangers of Downcoding

While downcoding typically doesn’t result in criminal fraud charges like upcoding does, it is still a non-compliant practice that harms the healthcare ecosystem.

Financial Loss: The most immediate impact is a loss of revenue. Medical practices operate on tight margins. Routinely under-billing for services rendered means the practice is not being paid for the work it is doing. Over time, this revenue leakage can threaten the solvency of the business, leading to an inability to invest in new technology, staff, or patient resources.

Inaccurate Medical Records: Billing codes are part of the patient’s medical history. If a patient has a severe condition that requires complex decision-making, but the bill reflects a minor ailment, the medical record is technically inaccurate. This can confuse future providers who rely on that history to make clinical decisions, potentially affecting patient safety.

Audit Flags: Ironically, consistent downcoding can trigger the very audits providers are trying to avoid. Analytics software used by payers looks for anomalies. A physician who treats complex patients but never bills above a Level 2 visit is a statistical outlier that may invite scrutiny.

The Fine Line: Unbundling vs. Upcoding

It is important to distinguish between upcoding and unbundling, although both are fraudulent.

Upcoding is a misrepresentation of the level or type of service. It falsifies the complexity (e.g., calling a simple repair a complex reconstruction).

Unbundling is a manipulation of the structure of billing. It takes a legitimate group of services that should be sold as a package deal and charges for them à la carte to increase the total price.

Both practices distort the true cost of care and result in overpayment. For example, laboratory panels often bundle several blood tests into one code. Unbundling would involve billing for each specific blood test individually. This not only inflates costs for the payer but often results in higher copays and deductibles for the patient.

Strategies for Prevention and Compliance

Preventing billing errors requires a proactive, multi-layered approach. It is not enough to simply tell staff to “be careful.” Practices must build systems that support ethical behavior.

1. The Golden Rule: Accurate Documentation

Documentation is the defense against both upcoding and downcoding. The medical record must tell the complete story of the patient encounter. If a procedure was complex, the notes must explain why.

Physicians should be trained to document:

- The medical necessity of the service.

- The time spent (if billing based on time).

- The complexity of medical decision-making.

- Relevant patient history that impacted the treatment plan.

If the documentation is vague, coders are forced to guess or downcode to be safe. Precise documentation empowers coders to bill the highest appropriate level without fear of audit.

2. Comprehensive and Ongoing Training

Medical coding is dynamic. The codes (CPT, ICD-10) change annually, and payer policies shift even more frequently. A code that was valid last year might be deleted or bundled this year.

Regular training for both administrative staff and clinical providers is non-negotiable. Physicians need to understand how their clinical notes translate into codes, and billers need to stay updated on regulatory changes. Investing in certification for coding staff (such as CPC or CCS) yields high returns in compliance and revenue integrity.

3. Implement Internal Audits

Do not wait for Medicare or an insurance company to audit your claims. Conduct regular internal audits to identify patterns of error.

- Random Sampling: Review a percentage of claims every month to check for accuracy.

- Focused Audits: Look specifically at high-risk areas, such as frequently used high-level E/M codes or modifiers (like Modifier 25 or 59).

- External Reviews: Periodically hire an outside billing expert or consultant to review your practices. They can offer an unbiased perspective and catch issues your internal team might miss due to familiarity.

4. Leverage Technology Wisely

Modern billing software and Electronic Health Records (EHR) systems often come with built-in “scrubbers” that check claims for errors before submission. These tools can flag potential upcoding (like mutually exclusive codes) or prompt providers when documentation seems insufficient for a selected code.

However, beware of automation bias. Some systems may suggest higher codes based on checkboxes, leading to unintentional upcoding. Technology should support human judgment, not replace it.

5. Foster a Culture of Ethics

Compliance starts at the top. Leadership must make it clear that ethical billing is a priority over short-term profit. If staff feel pressured to meet revenue targets at any cost, they may resort to upcoding. Conversely, if they fear punishment for denied claims, they may resort to downcoding.

Encourage open communication where billers can query physicians about documentation without fear of retribution. A culture of transparency reduces the risk of fraud and empowers the team to protect the practice.

Moving Forward: The Long-Term View

Navigating the financial complexities of healthcare has never been easy. Dense regulations and high stakes can make billing compliance feel like a burden—but that perspective misses its true value. Ethical billing is not just about avoiding penalties; it is a strategic asset that protects your organization and strengthens its foundation. At Care Medicus, we believe compliance done right is a competitive advantage.

Eliminating upcoding safeguards practices from severe legal and financial consequences, while eliminating downcoding ensures providers are fairly compensated for the expertise and care they deliver every day. When billing accurately reflects clinical reality, organizations protect revenue, reduce risk, and reinforce credibility with payers and patients alike.

The mission of every healthcare practice is to deliver exceptional care—and ethical billing makes that mission sustainable. By investing in staff training, prioritizing thorough documentation, and maintaining a vigilant compliance program, providers can navigate the revenue cycle with confidence and integrity. With deep expertise in compliant revenue cycle management, Care Medicus partners with healthcare organizations to build ethical, resilient billing practices that support long-term stability, patient trust, and community confidence.

Leave a Reply