Most people assume that having two health insurance plans means double the coverage and zero costs. If only it were that simple.

In reality, managing multiple insurance policies triggers a complex behind-the-scenes process known as Coordination of Benefits (COB). For healthcare providers and medical billing teams, COB is often a source of significant frustration. It involves navigating a maze of rules to determine which insurance pays first, which pays second, and how much the patient owes. Get it right, and you ensure timely reimbursement. Get it wrong, and you face denied claims, delayed revenue, and administrative headaches.

Whether you run a pharmacy, manage a medical practice, or are simply trying to understand your own dual coverage, mastering COB is essential. This guide explores exactly how Coordination of Benefits works, the rules that govern payment order, and how to overcome the common challenges of multi-payer systems.

What is Coordination of Benefits (COB)?

Coordination of Benefits (COB) is the process used by insurance companies to establish the payment order when a patient is covered by more than one health insurance plan.

The primary goal of COB is to prevent overpayment. Without these rules, a patient could potentially claim the full cost of a medical service from two different insurers, resulting in a profit. COB ensures that the total combined payment from all coverage sources does not exceed 100% of the allowable medical expenses.

For healthcare providers, COB is critical for revenue cycle management. It dictates:

- Whom to bill first: Identifying the primary payer.

- What to bill second: Submitting the remaining balance to the secondary payer.

- Compliance: Ensuring that billing practices align with state and federal regulations to avoid audits or clawbacks.

In a healthcare environment where administrative costs account for a quarter of total spending, streamlining the COB process is a vital step toward operational efficiency.

Understanding Primary, Secondary, and Tertiary Insurance

To manage multiple policies effectively, one must understand the hierarchy of payers. Insurance plans are not equal; they are assigned a “rank” based on specific COB rules.

Primary Insurance

The primary payer is the insurance plan responsible for paying the claim first, as if no other coverage existed. This plan pays its share of the covered expenses up to its policy limits. It does not care about the existence of other policies during the adjudication of the initial claim.

Secondary Insurance

Secondary insurance is billed only after the primary payer has processed the claim. The secondary payer reviews the Explanation of Benefits (EOB) from the primary insurer to see what was paid and what was denied.

Secondary insurance typically covers:

- Copayments

- Coinsurance

- Deductibles

However, secondary insurance will not pay more than its policy limit, and it will not pay for services that are not covered under its own plan, even if the primary plan covered them.

Tertiary Insurance

While less common, tertiary coverage comes into play when a patient has three active policies. This might happen if a patient has their own employer plan, coverage through a spouse, and a supplemental government plan (like TRICARE or Medicaid). The billing process follows the same logic: Primary first, Secondary second, and Tertiary third.

Key Rules and Guidelines for COB

Determining which plan is primary isn’t a guessing game. It is governed by a strict set of industry-standard rules established by the National Association of Insurance Commissioners (NAIC) and federal laws.

The “Birthday Rule”

This is perhaps the most well-known COB rule, used to determine primary coverage for dependent children when both parents have health insurance.

The rule states that the primary plan belongs to the parent whose birthday falls earlier in the calendar year (month and day only, not the year).

- Example: If the mother’s birthday is February 14th and the father’s is September 20th, the mother’s plan is primary for the children.

- Exception: If both parents share the same birthday, the plan that has been in effect longer is usually primary.

The Custodial Parent Rule

For divorced or separated parents, the Birthday Rule is often superseded by the Custodial Parent Rule. Unless a court order specifies otherwise, the order of benefits is typically:

- The custodial parent’s plan.

- The spouse of the custodial parent’s plan (stepparent).

- The non-custodial parent’s plan.

Medicare vs. Employer-Sponsored Plans

For seniors, COB rules depend heavily on employment status and company size.

- Working Aged (65+): If the patient works for an employer with 20 or more employees, the employer’s group health plan is primary, and Medicare is secondary.

- Small Business: If the employer has fewer than 20 employees, Medicare is generally primary, and the employer plan is secondary.

- Disability: For patients under 65 with a disability, the threshold is 100 employees. If the employer has 100+ employees, the group plan is primary.

State-Specific Regulations

While many rules are standardized, states like California, Texas, and New York have specific regulations regarding how quickly claims must be paid and how insurers communicate policies. Providers must be aware of the local statutes that might supersede or clarify general COB guidelines.

Read More >> Regulatory Shifts in Medical Billing 2025: ICD-11, E/M Coding, Telehealth & What Providers Must Know

The COB Process: A Step-by-Step Guide for Providers

Successfully managing COB requires a systematic approach at every stage of the patient journey, from the front desk to the back office.

1. Verify Coverage at Every Visit

Patient insurance data is not static. Jobs change, marriages happen, and policies expire. Front-desk staff should ask, “Have there been any changes to your insurance?” at every visit. They must capture data for all potential payers, not just the card on the top of the wallet.

2. Identify the Order of Payment

Using the rules mentioned above (Birthday Rule, employment status, etc.), the billing team must identify the primary payer. If there is ambiguity, contact the insurers directly. It is better to spend 10 minutes on the phone verifying primacy than months appealing a denied claim.

3. Submit the Primary Claim

Send the claim to the primary insurer. Ensure all coding is accurate to prevent a denial based on medical necessity or clerical errors.

4. Review the Primary Remittance

Once the primary payer responds with an EOB and payment (or denial), review the “Patient Responsibility” amount. This balance is what gets billed to the secondary payer.

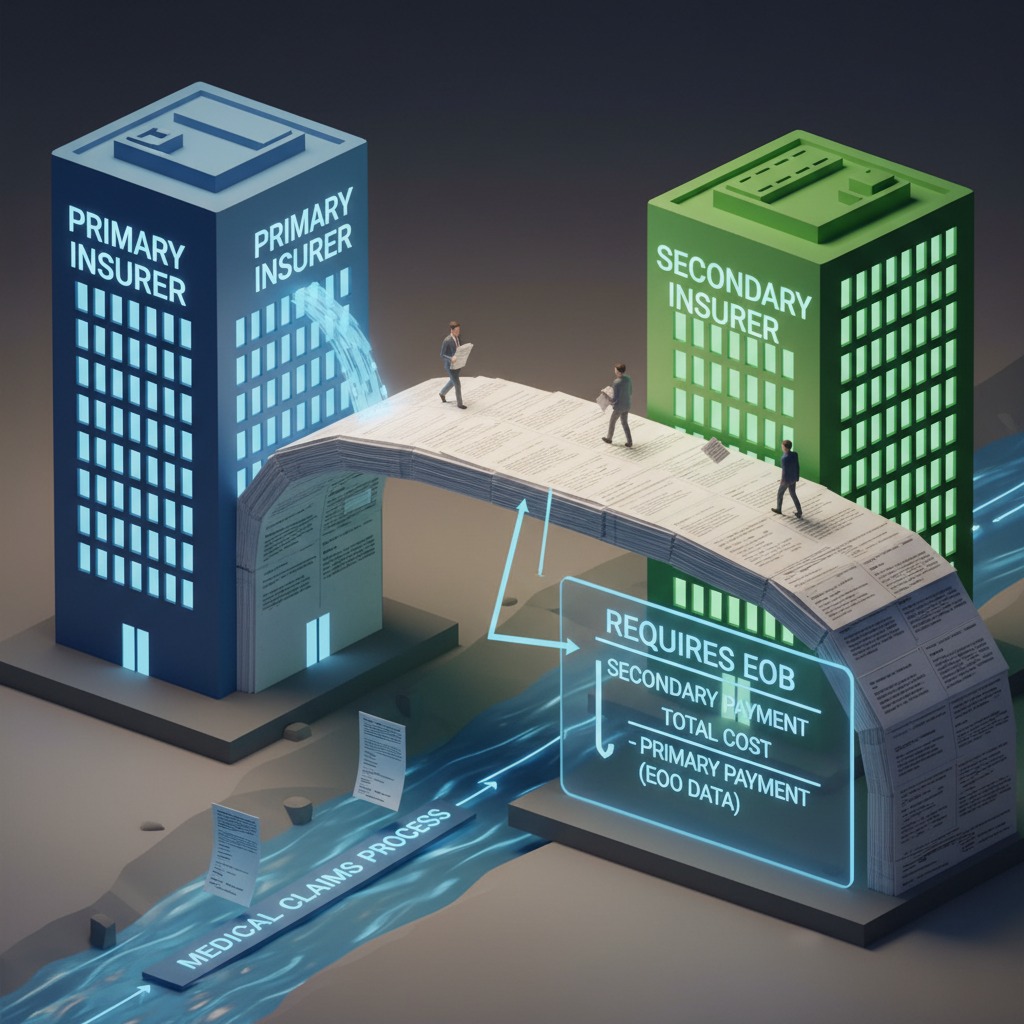

5. Submit the Secondary Claim

Submit the claim to the secondary insurer. Crucial Step: You must attach or electronically reference the primary payer’s EOB. The secondary payer needs proof of what the primary paid to calculate their portion. Without this, the claim will be rejected immediately.

Challenges in Coordinating Multiple Insurance Coverages

Despite clear rules, COB remains one of the most difficult aspects of medical billing. The complexity of multi-payer systems creates several operational hurdles.

Common Errors and Denials

The most frequent cause of COB denials is a mismatch in records. If Carrier A thinks they are secondary, but you bill them as primary, they will deny the claim stating, “Patient has other coverage.” This kicks off a time-consuming cycle where the patient must contact the insurer to update their Coordination of Benefits file.

Administrative Costs

Managing these claims requires manual intervention. Staff must track down EOBs, call payers to verify priority, and manage patient disputes. The American Hospital Association reports that hospitals spend millions annually on administrative costs related solely to claim errors and denials, a significant portion of which stems from COB issues.

Delayed Cash Flow

Secondary claims cannot be billed until the primary claim is fully adjudicated. This naturally extends the Accounts Receivable (AR) days. If the primary claim is denied or delayed, the secondary claim sits in limbo, negatively impacting the practice’s cash flow.

Strategies for Effective COB Management

To minimize denials and speed up reimbursement, healthcare organizations need proactive strategies.

Automated Eligibility Verification

Relying on patients to self-report the correct insurance hierarchy is risky. Implementing automated eligibility tools that check clearinghouses for all active coverage can verify primacy before the patient even sees the doctor. These tools can flag undisclosed coverage (like an active Medicare policy) that the patient may have forgotten to mention.

Integrated Billing Systems

Modern Practice Management (PM) and Pharmacy Management Systems should handle COB logic automatically. A robust system will allow you to load multiple carriers and automatically sequence the claims based on pre-set rules, generating the secondary claim the moment the primary payment is posted.

Regular Staff Training

Your billing staff and front-desk team are your first line of defense. Regular training on specific scenarios—such as how to handle workers’ comp versus private insurance, or how to apply the Birthday Rule—is essential. When staff understands why they need to ask specific questions, data quality improves.

Leverage Data Analytics

Use your billing data to spot trends. Are you seeing a spike in COB denials from a specific payer? Is there a pattern of denials related to student health plans? Analytics can identify these bottlenecks, allowing you to adjust your workflows or update your payer rules to prevent future rejections.

Read More >> Telehealth Billing and Reimbursement: A Point of Attention for Healthcare Providers

The Role of Technology in COB

The days of manually stapling a primary EOB to a secondary paper claim are (mostly) behind us. Technology is reshaping how COB is managed.

Automation and AI

Artificial Intelligence is beginning to play a role in predicting COB issues. AI-driven platforms can analyze patient demographics and historical data to predict the likelihood of other coverage. For example, if a patient is 66 years old, the system can prompt the user to check for Medicare status automatically.

Electronic Coordination of Benefits (COB)

Most clearinghouses now support electronic COB transactions. When the primary payer remits payment (835 file), the system can automatically “cross over” the claim to the secondary payer without human intervention. This significantly reduces the lag time between primary and secondary billing.

Real-World Scenarios: COB in Action

To visualize how this works, let’s look at a few common scenarios healthcare providers face.

Scenario A: The Working Senior

- Patient: 67 years old, still working full-time.

- Employer: A large tech company with 5,000 employees.

- Coverage: Employer Group Health Plan + Medicare Part A & B.

- The Verdict: Because the employer has more than 20 employees, the Employer Plan is Primary. Medicare is Secondary. If the provider bills Medicare first, the claim will be denied.

Scenario B: The College Student

- Patient: 20-year-old college student.

- Coverage: A University Student Health Plan + Dependent on Parent’s Plan.

- The Verdict: Generally, the plan where the patient is the subscriber (the student plan) is Primary. The plan where they are a dependent (the parent’s plan) is Secondary.

Scenario C: The Car Accident

- Patient: Injured in a car accident.

- Coverage: Auto Insurance (Personal Injury Protection) + Private Health Insurance.

- The Verdict: In most states, Auto Insurance is Primary for accident-related injuries up to the policy limit. Private Health Insurance is Secondary and will only pay once the auto limits are exhausted.

Best Practices for Healthcare Providers

To navigate the COB landscape successfully, providers should adhere to these best practices:

- Don’t assume data is current. Eligibility checks should be run within 24 hours of the appointment.

- Educate patients. Explain to patients that they must respond to letters from their insurance company regarding “other coverage.” If they ignore these inquiries, the insurer will deny all claims until the file is updated.

- Audit your credit balances. Sometimes COB errors result in overpayments (e.g., both primary and secondary paid the full amount). Regularly audit accounts to refund overpayments promptly and avoid compliance issues.

- Stay updated on regulations. Payer rules change. Subscribe to payer newsletters and CMS updates to stay ahead of changes in billing hierarchy.

The Future of COB

As healthcare moves toward greater interoperability, the promise of real-time coordination of benefits (COB) is becoming clearer—reducing guesswork and creating transparency around who pays first. At Care Medicus, we recognize that while technology will ease some friction, the growing complexity of coverage models means COB will remain a critical—and high-risk—function within the revenue cycle.

With the rise of gig economy health plans, high-deductible policies, and layered government subsidies, accurate coordination requires more than basic verification. It demands knowledgeable staff, disciplined workflows, and technology that can keep pace with evolving payer rules. Organizations that invest in these capabilities position themselves to prevent denials, reduce patient confusion, and protect reimbursement from the start.

Now is the time to strengthen your COB strategy. By training teams on nuanced coverage rules, maintaining rigorous verification processes, and leveraging intelligent technology, providers can turn COB from a source of friction into a competitive advantage. With proven expertise in eligibility and revenue cycle optimization, Care Medicus helps healthcare organizations build reliable, future-ready COB workflows that support cleaner claims, stronger patient trust, and a healthier bottom line.

Leave a Reply