It’s a scenario that plays out in front offices every day: A patient arrives for an appointment, confident their insurance covers the visit. You provide the care, submit the claim, and weeks later, it bounces back denied. The reason? “Coverage terminated” or “Service not covered.”

Now, your team is stuck in a cycle of rework, appeals, and awkward conversations with patients about surprise bills.

In the complex landscape of 2026 healthcare revenue cycle management (RCM), patient eligibility verification is no longer just a checkbox task—it is the financial backbone of a successful practice. With insurance plans becoming increasingly fragmented and high-deductible plans becoming the norm, the margin for error is razor-thin.

This guide will walk you through why verification is more critical than ever, provide a comprehensive 2026 checklist to foolproof your process, and explore how automation is reshaping the front desk.

Why Patient Eligibility Verification Matters More Than Ever

Patient eligibility verification is the process of confirming a patient’s insurance coverage and benefits prior to a medical encounter. While it sounds administrative, it has profound downstream effects on your practice’s financial health and patient relationships.

Minimizing Claim Denials

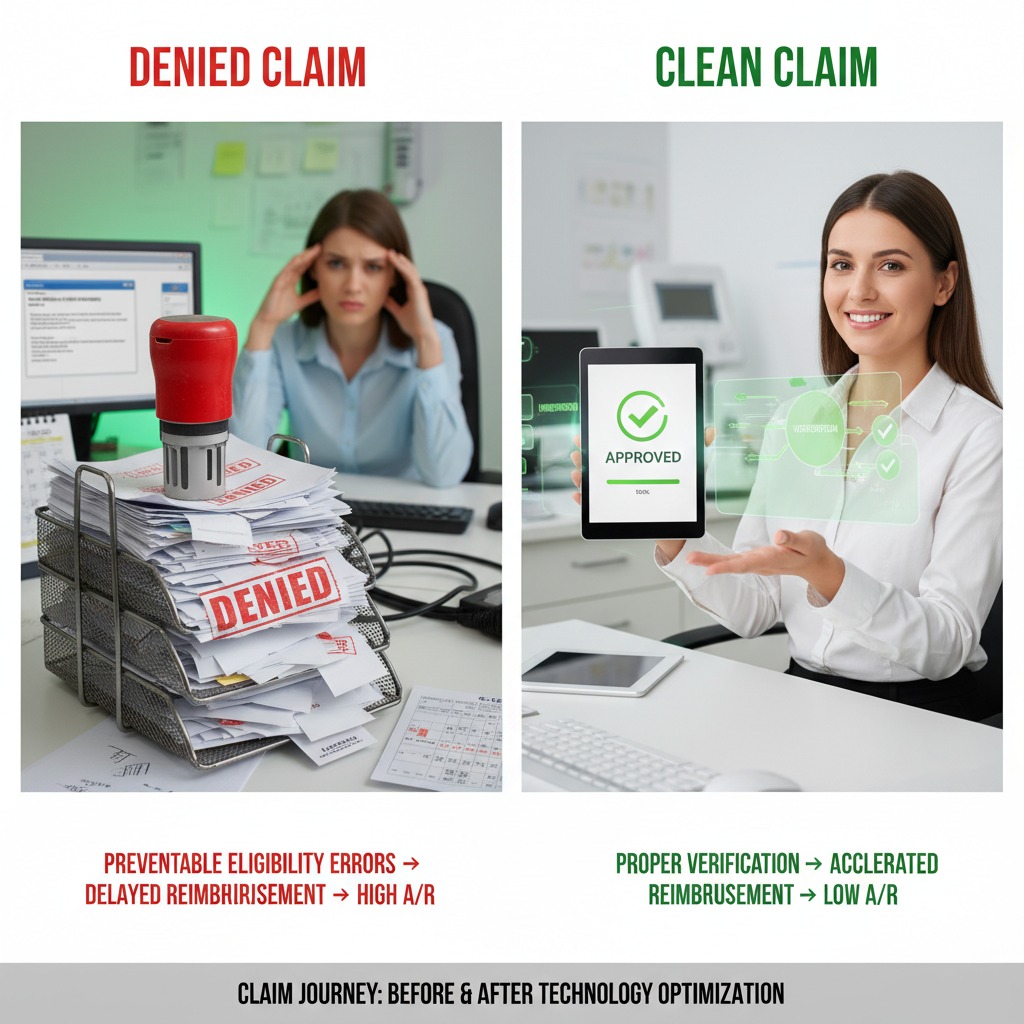

The most immediate impact of robust verification is a reduction in claim denials. Industry data consistently shows that approximately 9% of claims are initially denied due to eligibility issues. These are preventable errors. When you verify coverage before the patient walks through the door, you stop these denials dead in their tracks.

Accelerating Reimbursements

Cash flow is king. When a claim is clean—meaning it contains accurate patient and insurance data—it moves through the payer’s system faster. Eligibility issues are often the primary bottleneck in the reimbursement cycle. By catching inactive policies or incorrect member IDs upfront, you reduce the “days in accounts receivable” (A/R) and keep revenue flowing.

Enhancing the Patient Experience

Nothing erodes trust faster than a surprise medical bill. Patients today are consumers; they expect transparency regarding their financial responsibility. When you can accurately tell a patient, “Your deductible is $2,000 and you have $500 remaining, so today’s visit will cost $150,” you empower them. You move from being the bearer of bad news weeks later to being a partner in their financial planning today.

Step-by-Step Guide to Patient Eligibility Verification

To navigate the complexities of modern insurance plans, your practice needs a standardized protocol. This step-by-step guide and accompanying checklist are designed to ensure no detail slips through the cracks.

1. The Pre-Check (2-3 Days Before Appointment)

Don’t wait until the patient is standing at the front desk. The “Golden Window” for verification is 48 to 72 hours before the appointment. This gives your staff ample time to contact the patient if coverage has lapsed or if a referral is missing.

2. The Verification Checklist

Use this checklist for every patient, every visit. It covers the essential data points required to clear a claim for payment.

Core Insurance Details:

- Insurance Name: Ensure you have the specific plan name (e.g., “Blue Cross Blue Shield of Texas HMO” vs. just “BCBS”).

- Payer ID: The specific electronic ID for claim submission.

- Group Number: Identifies the employer or group plan.

- Policy/Member ID: Double-check specific alpha-numeric combinations, which are prone to transcription errors.

- Claims Mailing Address: Even in an electronic world, this validates you are hitting the right payer gateway.

- Provider Service Phone Number: For manual follow-ups.

Patient & Subscriber Demographics:

- Patient Name & DOB: Must match the insurance card exactly.

- Subscriber Information: If the patient is not the primary policyholder (e.g., a child or spouse), you need the subscriber’s name, DOB, and relationship to the patient.

- Gender: As listed on the insurance policy.

- Address: Verify the current home address on file.

Benefits & Coverage Specifics:

- Policy Status: Is the coverage active on the specific date of service?

- Effective & Termination Dates: When did the coverage start, and does it end soon?

- Plan Type: Is it an HMO, PPO, EPO, or POS? This dictates network restrictions.

- Service Eligibility: Is the specific procedure (e.g., physical therapy, MRI, behavioral health) covered under their plan?

- Plan Exclusions: Are there specific “carve-outs” for pre-existing conditions or specific therapies?

Financial Responsibility:

- Co-pays: The fixed amount due at the time of service.

- Deductibles: The total deductible amount and, crucially, the remaining deductible balance for the year.

- Co-insurance: The percentage the patient owes after the deductible is met.

- Out-of-Pocket Maximum: Has the patient met their cap for the year?

Authorization & Referrals:

- Referral Requirement: Is a referral from a Primary Care Physician (PCP) on file?

- Prior Authorization: Does the specific CPT code require pre-approval?

- Pre-authorization Number: If obtained, record the specific authorization code and the date range it is valid for.

Red Flags to Watch For

- Coverage Exhausted: Has the patient used up their allotted visits (e.g., 20 PT sessions per year)?

- Service Not Covered: Is the diagnosis code compatible with the patient’s benefits?

- Coordination of Benefits (COB): Is there a secondary payer? Which one is primary?

- Out-of-Network: If you are out-of-network, does the patient have out-of-network benefits?

Read More >> The Clinical Pathology Trap: Solving for Frequency Caps and Scrutiny on Modifier 91

Best Practices for Eligibility Verification & Referrals

Even with a checklist, the process can fail without the right habits. Here are the best practices for 2026.

Verify Insurance Coverage in Real Time

Batch verification the night before is good; real-time verification is better. Coverage can change overnight—literally. A patient might change jobs or miss a premium payment, causing a policy active on Tuesday to be inactive on Wednesday. Use tools that offer real-time connectivity to payer databases.

Collect Complete Patient Information Upfront

The root cause of many eligibility failures is bad data entry. Implement a “hard stop” in your intake process. If the front desk hasn’t captured a copy of the insurance card (front and back) and a government ID, the check-in process shouldn’t proceed. Train staff to ask open-ended questions like, “Have there been any changes to your insurance?” rather than “Is your insurance the same?”

Confirm Benefits for Specific Services

“Active coverage” does not equal “coverage for this service.” A patient may have active Blue Cross coverage, but their plan might specifically exclude chiropractic care or mental health services. Always verify benefits against the specific CPT codes you intend to bill.

Ensure Referral Documentation is On File

For HMO plans, a missing referral is an automatic denial that cannot be appealed. Ensure the referral is physically (or digitally) in the chart, that it is addressed to your specific practice/provider, and that it has not expired.

Integrate Eligibility Checks into Workflow

Verification shouldn’t be a standalone task; it should be woven into the fabric of your operations.

- Scheduling: Initial check.

- 72 Hours Prior: Deep dive verification.

- Check-in: Final “spot check” for changes.

Train Staff on Insurance Rules

Insurance isn’t static. Payer rules change annually, sometimes quarterly. Invest in regular training for your front desk staff so they understand the nuances between a PPO and an HMO, what a “deductible” really means, and how to read an eligibility response.

Automated Solutions for Enhanced Verification

In 2026, relying solely on phone calls to payers is a strategy for burnout, not growth. The debate between manual vs. automated verification is largely settled, but understanding the nuance is key.

Manual Verification:

- Pros: useful for complex cases requiring nuanced answers or specific clinical questions.

- Cons: Extremely time-consuming, prone to human error, and expensive in terms of labor hours.

Automated Solutions:

- Pros: Speed and scale. Automated tools can verify hundreds of patients in minutes. They integrate directly with Electronic Health Records (EHR) and Practice Management (PM) systems, auto-populating data fields and flagging issues instantly.

- Cons: Can sometimes return generic “active” responses without detailed benefit breakdowns for niche services.

The Hybrid Approach:

The most efficient practices use a hybrid model. They use automation to clear the 80% of routine cases and deploy their skilled staff to handle the 20% of complex cases that require a phone call. This “management by exception” strategy maximizes staff efficiency while ensuring thoroughness.

Read More >> AI Clinical Workflows in Action: Real-World Examples of Human-AI Synergy

Prioritizing Verification for Financial Health

The healthcare landscape of 2026 demands precision. As margins tighten and administrative pressures continue to rise, practices can no longer afford to lose revenue to preventable eligibility errors. At Care Medicus, we understand that eligibility verification is not just a front-end task—it is a critical safeguard for the entire revenue cycle.

Getting eligibility right does more than ensure timely reimbursement. It creates a seamless, professional experience for patients, reduces downstream billing issues, and allows clinical teams to focus on care rather than administrative friction. By implementing robust eligibility checklists, following proven best practices, and leveraging the right technology, healthcare organizations can protect revenue while strengthening patient trust.

Now is the time to act. With deep expertise in revenue cycle optimization and eligibility workflows, Care Medicus helps practices build reliable, technology-enabled verification processes that prevent denials before they occur. The result is a stronger financial foundation, smoother operations, and a patient experience that reflects accuracy, transparency, and confidence from the very first interaction.

Leave a Reply